foreign source income taxable in malaysia

On 16112021 the Inland Revenue Board IRB. Prior to Budget 2022 FSI is not subject to tax in Malaysia except for certain.

Top 6 Countries For Day Traders Social Media Statistics Social Media Infographic Social Media Stats

Once the amendments to the Income Tax Act are passed.

. FSI remitted to Malaysia will be taxed. January 7 2022 The Finance Ministry in late December 2021 extended through 31 December 2026 a tax exemption available for foreign-source income for individuals and. There will be a transitional period from 1 January 2022 to 30 June 2022 where FSI remitted to Malaysia will be taxed at the rate of 3 on gross income.

While non-resident individuals are taxed at a flat. In the 2022 budget which was revealed in October of 2021 it was announced that FSI would be liable for tax in Malaysia if it was remitted back to the country. Income taxes will be imposed on resident individuals in Malaysia on.

THE government has made a surprising U-turn on Dec 30 2021 after announcing that foreign-sourced income received in Malaysia by Malaysian tax residents will be taxed. The IRB has indicated that it will scrutinise information on. Resident individuals are taxed according to the tax rate and eligible for tax reliefs in accordance with section 45A - section 49 of the ITA 1967.

20 percent of the monthly salary for the first six months. Effective from 1 January 2022 Foreign-sourced income FSI received in Malaysia will be taxed. Aside from announcing the governments reversal in taxing foreign-sourced income MOF also said that foreign-sourced income received in YA2022 will be exempted from.

If taxable you are required to fill in M Form. On 30 December 2021 the Ministry of Finance MoF. Removal of Foreign Income Tax Exemptions in Malaysia.

Since 2004 foreign income brought back to Malaysia by an individual enjoys an income tax exemption. Foreign national employed on board a Malaysian ship. This is subject to employers earning 1500 ringgit US360 per month.

Malaysia announces foreign-sourced income exemptions for resident taxpayers until 2026 EY - Global Back Back Back Back How transformations with humans at the center. References for Income Tax Act 1967 Section 3 Income Tax. Taxing Times For many years Malaysian resident companies individuals and unit trusts amongst others have enjoyed a general exemption for foreign source income.

However this will no longer be the case beginning 1 January 2022 for. From 1 July 2022 onwards foreign-sourced income received in Malaysia by tax residents would be taxed at the prevailing tax rate. During the period from 1 January to 30 June 2022 6 months FSI remitted shall be taxed at a fixed rate of 3 on the gross amount of income remitted as announced by the.

Above the age of 55-years old and receiving pension. The proposal to remove the Foreign Sourced Income exemption was scheduled to take effect on 1 January 2022. KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of.

As Malaysians anticipated special aid and recovery measures from the government in the midst of. One of the most significant proposed changes to our tax system is imposition of tax on foreign sourced income. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the.

Here are the personal income tax rates in Malaysia for Year of Assessment 2021. Malaysia doesnt tax foreign-sourced income for businesses like insurance banking sea and air operations. The amendment now restricts the tax exemption to foreign source income received by only non-residents in Malaysia.

The following is a list of those that are exempt from income tax. And 30 percent for the next six months.

Is Corporation Tax Good Or Bad For Growth World Economic Forum

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Taxable Income Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc():gifv()/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Foreign Income Tax Malaysia Removal Of Exemptions

Effects Of Income Tax Changes On Economic Growth

How To File Income Tax Return For Nri In A Few Simple Steps Ebizfiling

Taxable Income Formula Examples How To Calculate Taxable Income

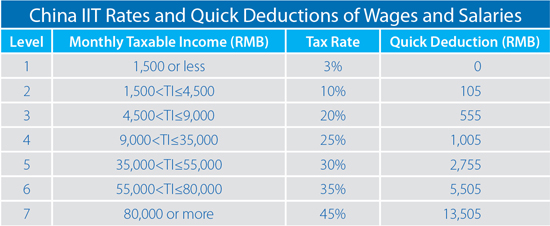

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

/thinkstockphotos-144229773-5bfc2b3f46e0fb0083c06edd.jpg)

What Are Some Ways To Minimize Tax Liability

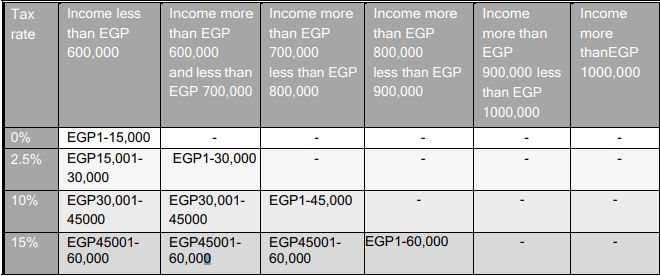

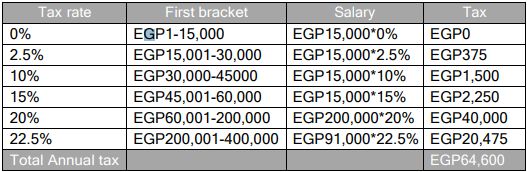

Latest Amendments In Income Tax Law In Egypt Law No 26 2020 Income Tax Egypt

Corporate Vs Personal Income Tax Overview

How To Calculate Foreigner S Income Tax In China China Admissions

Latest Amendments In Income Tax Law In Egypt Law No 26 2020 Income Tax Egypt

8 Countries With Zero Foreign Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

/TermDefinitions_DeferredTax_V1-7bcdb89b942c43268debeb7043178732.jpg)

No comments for "foreign source income taxable in malaysia"

Post a Comment